regional income tax agency forms

Box 94736 cleveland oh 44101-4736 fax. Use our library of forms to quickly fill and sign your RITA Ohio forms online.

![]()

The Regional Council Of Governments Regional Income Tax Agency

Regional Income Tax Agency Form 17.

. Streamlined Document Workflows for Any Industry. Individual Estimated Income Tax andor Extension of Time to File. Please complete and sign this Registration Form and return within 10 business days.

Rita income taxsignNow offers a separate application for mobiles working on Android. Weve already started mailing checks. NYS-50-T-NYS 122 New York State withholding tax tables and methods.

Follow these simple actions to get Form 37 - Regional Income Tax Agency completely ready for sending. Complete all necessary information in the required fillable. Find the document you need in the library of templates.

In order to add an electronic signature to a PDF form 37 regional income tax agencies follow the step-by-step instructions below. Easily find the app in the Play Market and install it for signing your PDF form 37 regional income tax agencies. Therefore the signNow web application is a must-have for completing and signing Ohio regional income tax agency form 37 2007 on the go.

You may also go to an agencyauthoritys. Residence tax withheld phone number title date section a 1. The opportunity to pay in full and have a 1 discount applied to your total will expire on February 10 2021.

Follow our easy steps to get your Regional Income Tax Agency Forms ready rapidly. All Extras are IncludedNo Fees Necessary. Due to executive order 20292 by the Governor the County 2021 Tax deadline is being extended until March 12 2021.

Form 11A Adjusted Employers Municipal Tax Withholding Statement. Adjusted federal taxable income form 1120s form 1065. RITA will calculate your estimate.

Now creating a Regional Income Tax Agency Forms takes at most 5 minutes. Regional Income Tax Agency RITA Individual Income Tax Return. Get Ohio regional income tax agency form 37 2007 signed right from your smartphone using these six tips.

Riverhead New York 11901. If you have any questions please contact the Registration. Find Forms for Your Industry in Minutes.

Begining March 13 2020 there will be only limited access to the services of the Suffolk County Real Property Tax Service Agency until further notice. The centre tax agency cta also known as the state college borough was established as a result of act 32 of 2008 in order to provide tax collection services for. Pick the template from the catalogue.

Make an appointment at the local office. Form 10A Application for Municipal Income Tax Refund. Do not use staples tape or glue.

Fees and other forms of compensation. Avoid penalties and interest by getting your taxes forgiven today. Documents may be mailed to the agency at 300 Center Drive Riverhead New York 11901 or they may be.

Guaranteed Accurate Calculations and Maximum Refund. Ad Premium State Tax Software. Use this form to allocate existing paymentscredits between separate individual accounts.

To understand how we calculate your credit amount see Homeowner tax rebate credit amounts. Total wages subject to workplace tax regional income tax agency po. Request for Allocation of Payments.

Credit Rate Worksheet enter each wage separately. If you need additional assistance with the filing of your form 11 please feel free to call us at 8008607482 or tdd. If the agencyauthority you seek is not listed please access the Open FOIL NY Resource Center or New York State All Agencies website for more information.

Ad State-specific Legal Forms Form Packages for Government Services. Open the template in our online editor. The centre tax agency cta also known as the state college borough was established as a result of act 32 of 2008 in order to provide tax collection services for.

Withholding Tax Computation Rules Tables and Methods. This publication contains the wage bracket tables and exact calculation method for New York State withholding. You may use the form below to submit a FOIL request.

Form 37 2021 Page. If youre not sure you qualify for the HTRC see HTRC. State of Ohio Individual and School District Income Tax.

State and County Tax will be. Our state browser-based samples and complete recommendations remove human-prone mistakes. 4409223536 municipality workplace wages workplace tax withheld residence tax withheld 11lf05a check here if you have any changes to your distribution and complete section b on.

Select the fillable fields and include the necessary details. The tax tables and methods have been revised for payrolls made on or after January 1 2022. Send to someone else to fill in and sign.

Form 20 - EXT Net Profit Estimated Income Tax andor Extension of Time to File. Regional income tax agency po. Form 32 EST-EXT Estimated Income Tax andor Extension of Time to File.

Get ohio regional income tax agency form 37 2007 signed right from your smartphone using these six tips. Ad Apply For Tax Forgiveness and get help through the process. Forms are available online at the Regional Income Tax Agency RITA website or by calling 800.

3 1 Regional Income Tax Agency RITA Ohio form is 2 pages long and contains. Broadview Heights OH 44147-7900. In a matter of seconds receive an electronic document with a legally-binding signature.

Single or Married Filing Separately. Please note by law we cannot issue checks for the HTRC that are. Request for Allocation of Payments.

Form 27 Net Profit Tax Return. Request Records Using the. Please call the office at 431-1008 or use the yellow dropbox outside of city hall.

Preparers signature preparers address. Fill has a huge library of thousands of forms all set up to be filled in easily and signed. 0 Federal only 1499 State.

Form 17 Reconciliation of Income Tax Withheld. Application for Municipal Income Tax Refund. Use this lookup to determine the amount youll receive for the homeowner tax rebate credit HTRC.

Losses that directly relate to the sale exchange or other. Use this form to allocate existing paymentscredits between separate individual accounts. All forms are printable and downloadable.

Go through the instructions to discover which info you need to provide. Use Form 32 EST-EX T to pay 61522 91522 and 11523 estimates. Postal Wage Amendment Statement Form.

Form 32 EST-EXT. Estimated Income Tax andor Extension of Time to File. Please be advised that failure to timely register with RITA may result in delays in the processing of any required income tax filings or may result in future penalty and interest charges if applicable.

All fields marked are required for a successful submission.

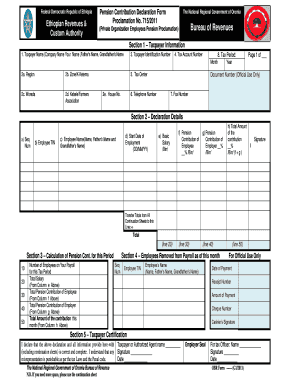

Ethiopian Income Tax Declaration Form Fill Online Printable Fillable Blank Pdffiller

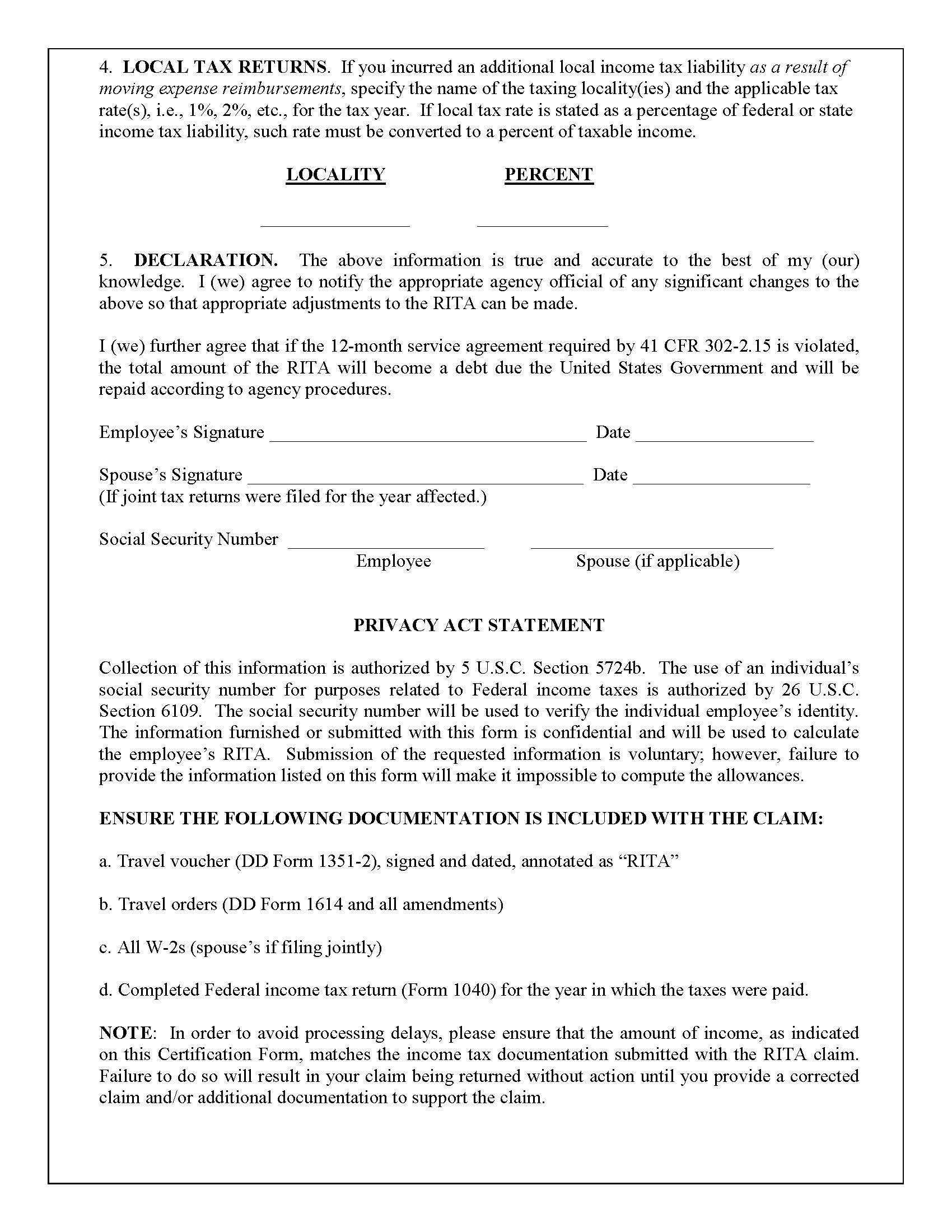

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Income Tax City Of Gahanna Ohio

![]()

Individuals Refunds Regional Income Tax Agency

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Income Tax City Of Gahanna Ohio

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

![]()

Individuals Refunds Regional Income Tax Agency

Income Tax City Of Gahanna Ohio

![]()

Individuals Refunds Regional Income Tax Agency

Income Tax City Of Gahanna Ohio

Ethiopian Income Tax Declaration Form Fill Online Printable Fillable Blank Pdffiller

Individuals Refunds Regional Income Tax Agency

Individuals Refunds Regional Income Tax Agency

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service