average property tax in france

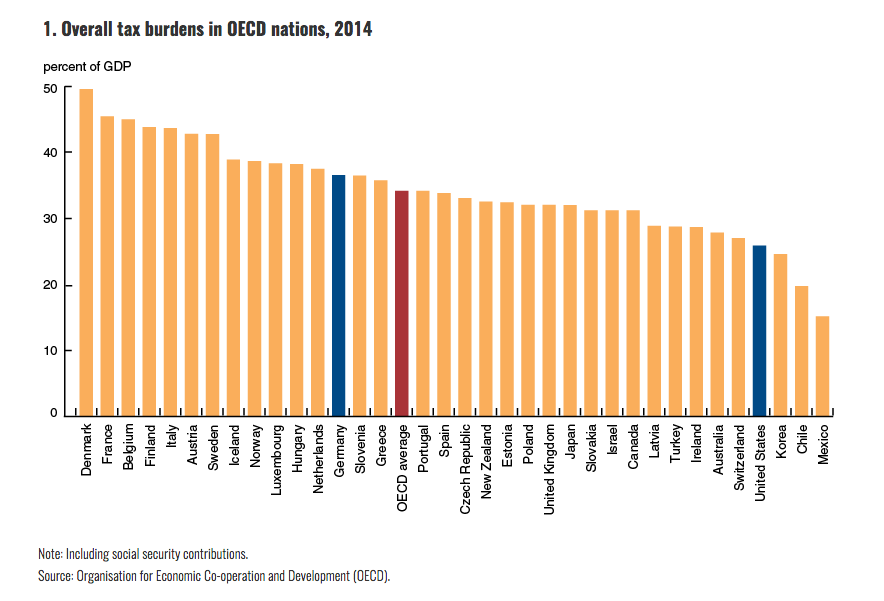

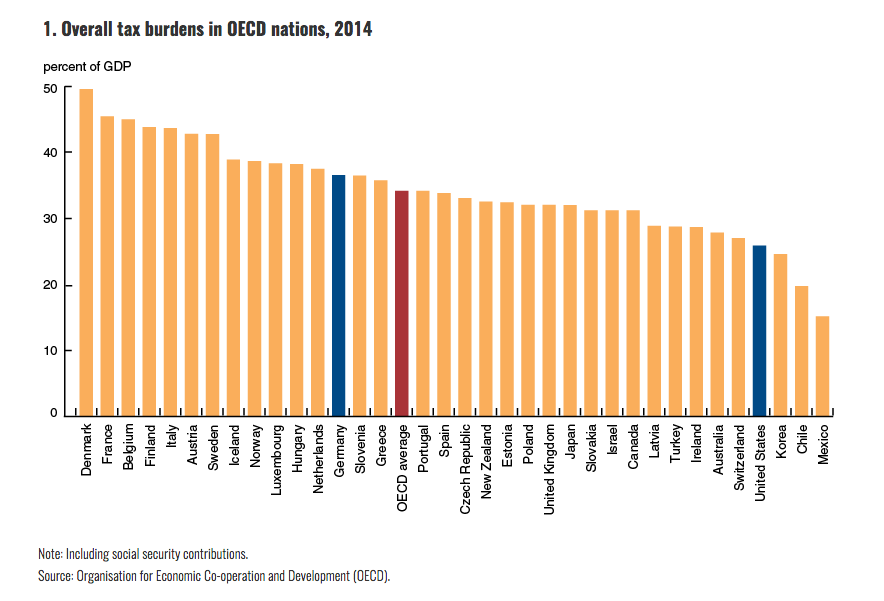

There are two main property taxes in France plus a wealth tax according to Jessica Duterlay a tax associate at Attorney-Counsel a law firm with offices in. Efforts to control the increase in the tax burden have been made by the states of the OECD.

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

France ranked 2nd out of 38 OECD countries in terms of the tax-to-GDP ratio in 2020.

. This is the average yearly salary including housing transport and other benefits. Average price per hectare of free land and meadows in Brittany 2016-2018. Property Taxes Taxe Foncière.

In France many of the costs associated with property sales are folded into one big fee which encompasses both taxes and other fees. For French non-residents taxes will usually be taken on France-sourced incomes at a 30 tax rate. Obviously all countries have a different way of calculating taxes and different tax segments.

This page provides the latest reported value for - France Personal Income Tax Rate - plus previous releases historical high and low short-term. Property owners in France have two types of annual tax to pay. Property Tax Assistant salaries vary drastically based on experience skills gender or location.

Information on income tax rates in France. Income tax rates are applied on a fractional basis so that each household part of the income is charged progressively as we outlined in the previous sectionThus if a couple have net income of 30000 in the year there are two parts of 15000 with each part taxed using the scale rates. This tax is actually comprised of the.

Average price per hectare of free land and meadows in Ile-de-France 2016-2018. France Residents Income Tax Tables in 2020. Salaries range from 18200 EUR lowest to 62800 EUR highest.

Income Tax Rates and Thresholds Annual Tax Rate. Buyers in Paris will have to pay stamp duties on the purchase according to Jessica Duterlay a tax associate at Attorney-Counsel a. The VAT is a sales tax that applies to the purchase of most goods and services and must be collected and submitted by the merchant to the France governmental revenue department.

The figure is based on the rental value of the property and the rate of tax is determined annually by the authority. In 2019 France was also ranked 2nd out of the 38 OECD countries in terms of the tax-to-GDP ratio. Therefore to compare these two countries lets take the salaries of someone who gains 28 000 a year 45 000 a year and 113 000 a year and see how much they have left after taxes in each country.

This is why France continues to be among the OECD countries whose tax rate is the highest. However French property maintenance taxes break down a bit further into 2 types. A person working as a Property Tax Assistant in France typically earns around 39500 EUR per year.

Therefore to compare these two countries lets take the salaries of someone who gains 28 000 a year about 33 000 45 000 a year about 53 000 and 113 000 a year about 132 500 and see how much they have left after taxes in each country. France is notorious for being one of the highest tax-paying countries in Europe so it should come as no surprise that as there are taxes to pay as a French homeowner. Single worker One-earner married couple with two children The tax wedge for the average single worker in France decreased by 06 percentage points from 472 in 2019 to 466 in 2020.

Several real property taxes apply in France including the CET see Other below the taxe fonciere and the 3 tax See also Transfer tax below Payroll tax. In 2020 the average single-family home in the United States had 3719 in property taxes for an effective rate of 11. Heres what you need to know about French property taxes including your tax-paying responsibilities tax rates and how to pay your property tax bills.

Taxes account for 45 of GDP against 37 on average in OECD countries. From 1st January 2019 monthly payments on account of tax Prélèvements a la source were introduced. For property tax on the earnings from the sale of properties in France rates are set to 19 for all EU citizens and 3333 otherwise.

The French tax year is equal to the calendar year. Personal Income Tax Rate in France averaged 4707 percent from 1995 until 2020 reaching an all time high of 5960 percent in 1996 and a record low of 2250 percent in 2015. Remember tax rules in France change frequently.

Taxing Wages - France Tax on labour income The tax wedge is a measure of the tax on labour income which includes the tax paid by both the employee and the employer. Taxes in France are high and the capital city is no exception. Filing deadlines for French income tax returns.

The current France VAT Value Added Tax is 2000. The Personal Income Tax Rate in France stands at 45 percent. ATTOM Data Solutions provides a county-level heat map.

This raised 323 billion in property taxes across the nation. In 2019 homeowners paid an average of 3561 raising 3064 billion. Check all the suggestions below with your English speaking French real estate professional.

Exact tax amount may vary for different items. Filing dates for the annual income tax return for both residents and non-residents can be found in our 202122 tax information sheet. Have you seen our French real estate buyers guide that comes with a 100 percent money back guarantee.

In 2020 France had a tax-to-GDP ratio of 454 compared with the OECD average of 335. Aggregate Local Property Tax Stats. About 20 tax on a 100 purchase.

The tax rate decelerated during the 90s and has decreased slightly since 2000. Payroll tax is levied on entities that collect revenue not subject to VAT mostly banks and financial institutions. This is a land tax and and is always paid by whoever owns the property on January 1st of any given fiscal year.

Obviously all countries have a different way of calculating taxes and different tax segments.

Average Appraisal Is Half Of A Percent Less Than Expected Rocket Mortgage Press Room Quicken Loans Home Refinance Home Appraisal

U S Spends Comparatively Little On Public Disability Benefits Disability Disability Benefit Budgeting

An Overview Of The Taxation Of Residential Property Is It A Good Idea Public Sector Economics

Levying The Land The Economist

Taxe D Habitation French Residence Tax

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax States

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

French Property Tax Considerations Blevins Franks

A Two Speed Recovery Global Housing Markets Since The Great Recession Housing Market Global Home Global

Family Structure Matters More For U S Students Single Parent Families Single Parenting Family Education

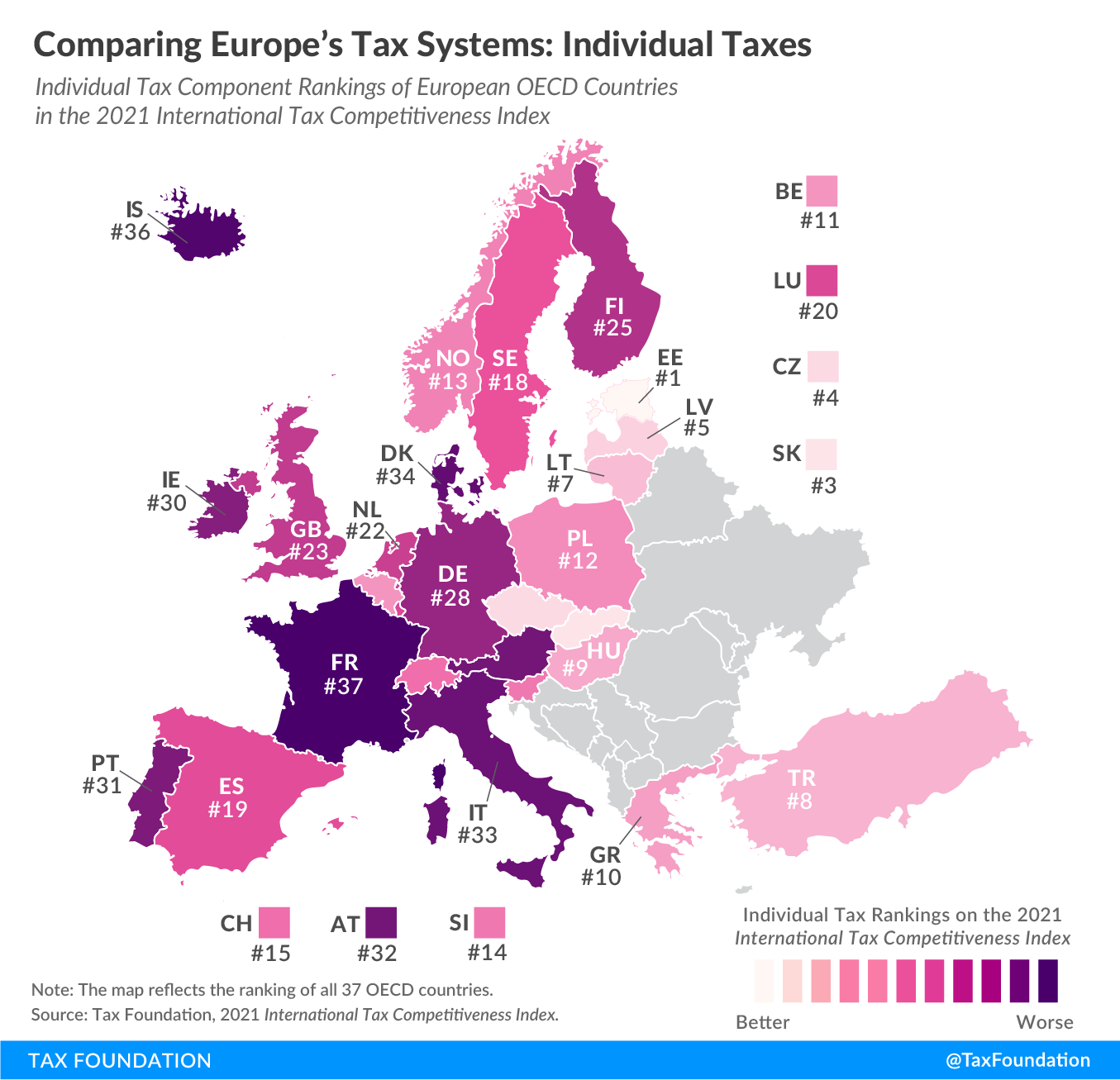

Comparing Income Tax Systems In Europe 2021 Tax Foundation

Taxe D Habitation French Residence Tax

In Depth Guide To French Property Taxes For Non Residents Expats

Who Pays More In Taxes U S Vs Europe Developed Countries Money

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

When Is The Best Time To Buy A Home Mortgage Interest Rates Home Buying Home Mortgage